The biotechnology industry achieved many firsts this past year, from the first approved drug that can slow the rates of cognitive and functional decline in adults with Alzheimer’s disease, to the first CRISPR-based gene editing therapy. But another first that occurred during 2023 should give drug and tool developers—and their investors—reason for concern.

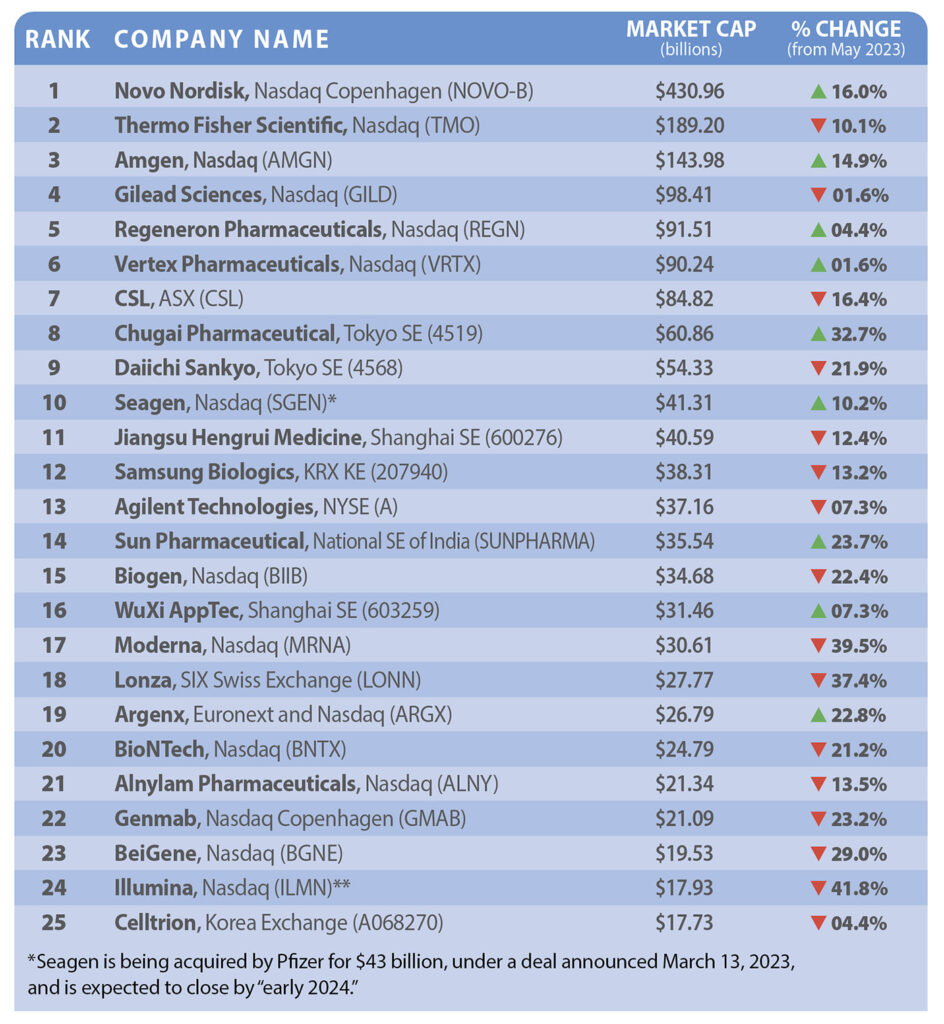

For the first time since 2012, when GEN began compiling its A-Lists of top biotechnology companies, we report a year-over-year decline in the market capitalization (the product of the share price and the number of outstanding shares) of the listed companies. As of December 8, 2023, the 25 largest biotechnology companies had a combined market capitalization of $1.711 trillion, down 2.2% from the $1.75 trillion market cap of GEN’s Top 25 Biotech Companies of 2023, an A-List published in May 2023.

However, biotechnology remains a profitable investment in the long term. Over the past five years, the market cap for the top 25 biotechnology companies soared nearly 78% from the combined $963.495 billion reported in GEN’s Top 25 Biotech Companies of 2019.

But the one-year decline is unmistakable evidence of how bearish the market has become for biotechnology companies, with investors reacting to the end of pandemic era surges in public and private financing, plunging COVID-19 vaccine sales, and the “patent cliff” loss of exclusivity by 2030 of more than 20 drugs.

Reporting ups and downs

Enduring this year’s biggest loss of market cap among top biotechnology companies was Illumina. The sequencing giant saw its market cap plummet 41.8% since last year, from $30.79 billion to $17.93 billion, and its ranking on GEN’s A-List fall from No. 17 to No. 24. Illumina’s problems included disappointing earnings, activist investor Carl C. Icahn’s proxy campaign, shareholder ouster of the chairman, the subsequent resignation of CEO Francis deSouza, and U.S. and European regulatory rebukes to its acquisition of cancer blood test developer Grail.

Among this year’s gainers, the biggest was Roche-owned Chugai Pharmaceutical, which climbed three notches from No. 11 to No. 8 thanks to a 32.7% jump in its market cap, from $45.86 billion to $60.86 billion. Chugai saw investors respond to positive announcements that included FDA acceptance of its biologics license application for paroxysmal nocturnal hemoglobinuria treatment crovalimab, and Japanese approval of its combination therapy Phesgo for HER2-positive breast and colorectal cancer.

A spot check by GEN reveals that all of the top 10 electronic transfer funds (ETFs) reported year-over-year losses as of December 8, compared with 6 of the top 10 showing year-over-year gains in GEN’s May 2023 A-List of top 25 biotechnology companies.

By comparison, the overall Standard & Poor’s (S&P) 500 index, which tracks 500 of the largest U.S. public stocks, rose 11.8% from May 2, 2023, through December 8, 2023, from $4,119.50 to $4,604.37—and 16.2% from December 8, 2022, when it stood at $3,963.51, through December 8, 2023.

The biggest one-year decliner among the biotechnology ETFs (down 40.2%) was Direxion Daily S&P Biotech Bull 3X Shares (LABU), the fifth-largest ETF with about $1.111 billion in total assets (dropping from $137.60 to $88.63). The smallest year-over-year loss was reported by SPDR S&P Biotech ETF (XBI), the second-largest biotechnology ETF with total assets of $6.425 billion.

The largest biotechnology ETF with $6.67 billion in total assets, the iShares Biotechnology ETF (IBB), fell 8.8% year over year, from $135.89 to $123.88. Third-ranked ARK Genomic Revolution ETF ($1.822 billion) slipped 8.5%, from $31.26 to $28.60.

Total asset figures were supplied by VettaFi, a provider of ETF and other data, analytics, and thought leadership for asset managers.

Making the list

This A-List presents GEN’s updated list of the top 25 biotechnology companies, ranked by their market caps as of December 8, 2023—as indicated by the exchanges on which the companies’ shares are traded, or by other publicly available sources. Each company is listed by rank, name, market cap in billions of dollars, and percentage change from last year. (Figures are rounded off to the nearest hundredth.)

This list does not include pharmaceutical companies that have a heritage of small-molecule, nonbiologic drug development. (In recent years, GEN has covered these companies through a separate list.)

Going back to the first GEN A-List in 2012, 14 top biotechnology companies that were listed back then do not appear here—because they were acquired, because their market caps fell below those of the top 25 companies, or because they restructured operations to reduce biopharmaceutical drug and life sciences tool development to less than half of total revenue.

Among January 2024’s top 25 biotechnology companies, losers of market cap (16) outnumbered gainers (9)—compared with 16 gainers and 9 losers in May 2023.

Companies headquartered outside the United States accounted for more than half (14) of the companies ranked on this latest A-List of top 25 biotechnology companies, one more than on GEN’s previous A-List published in May 2023, though one ex-U.S. company that made this year’s list did not appear last year.

Of the 14 headquartered outside the United States, three are based in China; two each in Denmark, Japan, and South Korea; and one each in Australia, Germany, India, the Netherlands, and Switzerland.

The smallest company listed this year has a market cap of nearly $18 billion, compared with just under $16 billion for the 25th ranked company on GEN’s May 2023 list.

Just missing the list at number 26 is BioMarin Pharmaceutical, which had a market cap of $17.51 billion on December 8, followed by WuXi Biologics ($15.94 billion), UCB ($15.52 billion), Novozymes ($14.44 billion), and bioMérieux ($12.47 billion).

The post Top 25 Biotech Companies of 2024 appeared first on GEN – Genetic Engineering and Biotechnology News.